As the world becomes increasingly interconnected, the US dairy industry is also expanding its presence throughout the world as processors focus on production and innovation for both domestic and international markets.

US dairy exports have continued a growth trajectory and increased in both volume and value since 2022 as the country continues to establish itself as a major global dairy producer. Additionally, exports grew more than domestic consumption during 5 out of the last 6 years, said William Loux, vice president of global economic affairs for the Arlington, Va.-based US Dairy Export Council.

“We have made a lot of investments as an industry in promoting export business around the world, especially in Asia, as well as in Latin America, where we saw particular success last year,” Loux said.

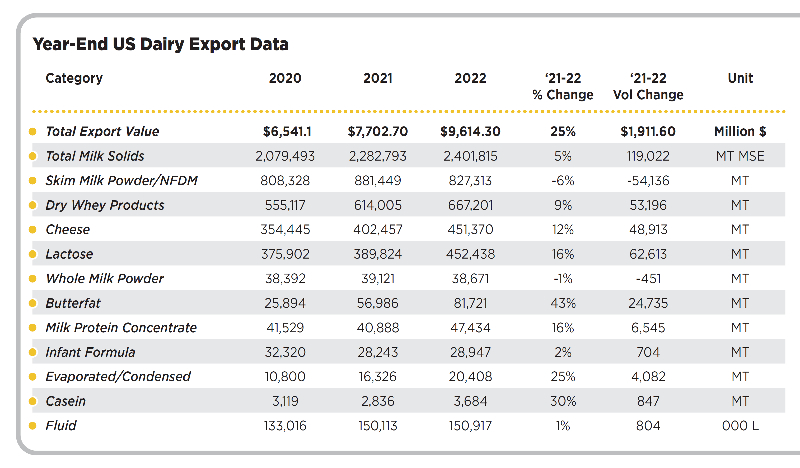

2022 US dairy exports reached $9.5 billion, exceeding 2021 values by 25% and representing an 85% increase over the last 10 years, according to US Department of Agriculture data. Export volume during the year increased to 2.82 million metric tons, a 52% increase over the last 10 years.

“We really are the one major dairy producing and exporting region that is focused on growth, that has the capacity for growth and that is putting in new capacity in order to meet the growing demands around the world,” Loux said.

From the clearing of pandemic-related supply chain congestion to the continued growth of middle class incomes and animal protein consumption across Southeast Asia, many factors have contributed to the growth of US exports, said Becky Rasdall, vice president of trade policy and international affairs at the International Dairy Foods Association (IDFA), Washington, DC.

Reaching diverse markets

Technology has played a role in allowing consumers in global markets to learn about US-made products, as well as allow producers to expand their reach and sales through targeted marketing campaigns. An increased interest in healthy lifestyles and wellbeing around the world has also caused more consumers to incorporate cheese, yogurt and other dairy products into their diet, said Danica Nilsestuen, grants and business programs director for the Wisconsin Cheese Makers Association, Madison, Wis.

Some of the most significant engines of growth in 2022 for US dairy products were Mexico and Latin America, where the US continued to supply a higher volume of both cheese and ingredients. These markets have also been consuming more natural cheeses as opposed to processed cheeses, boosting the volume of cheeses going into those markets, Loux said.

Additionally, the US continues to grow its presence in its second-largest dairy export market of Southeast Asia, which includes countries like Indonesia, Philippines, Malaysia and Vietnam.

“(Southeast Asia) is unfortunately being hit with significant demand headwinds now given inflation and economics, but long-term we see a lot of potential there,” Loux said. “You’ve got growing incomes, you’ve got a growing population, you’ve got consumers looking to dairy as those incomes rise and ultimately as their tastes change.”

Photo: Sunday Stock - stock.adobe.com

Photo: Sunday Stock - stock.adobe.com

While demand from these markets is growing, demand from China has been softer recently as the country has focused on reducing inventories that built up during the pandemic. At the same time, several key dairy-producing regions like Europe have stagnated exports recently, giving the US an opportunity to meet needs around the world.

In response to all these factors, farmers, cooperatives and processors are viewing dairy as a growing industry overseas and expanding capacity. This includes increasing production of mozzarella and America-type cheeses like cheddar and Colby and establishing more high-value butter and skim milk powder plants, Loux said.

“From a global standpoint, we’re seeing the most demand for products like milk powders, whey proteins, cheese and butter,” said Dale Mills, Jr., vice president of global sales for DFA Ingredient Solutions. “In order to meet global demand, there has been significant increased production capacity in the US, especially in the cheese and whey proteins space.”

Supportive trade policies will be necessary going forward, Rasdall said. IDFA has worked with both Congress and government agencies to communicate the rights of exporters regarding ocean carriers, and one success in these efforts has been the passing of the Ocean Shipping Reform Act.

The US-Mexico-Canada Agreement came into place in the summer of 2020, and while there was initial anticipation it would bolster exports to Canada, the country hasn’t implemented its commitments as hoped. This has prompted IDFA to encourage the Office of the US Trade Representative to dispute tariff rate quotas, Rasdall said.

“We would like to see Canada meet their obligations under the agreement and allow us to ship as we are supposed to,” Rasdall said.

Another challenge in the global market is the current lack of work in developing new trade agreements.

“We are in a period right now in the US where we are not negotiating trade agreements that reduce tariffs and result in zero-tariff access, so we haven’t quite seen the impact of that being put on hold yet in our trade data, but I do think it’s something that’s going to catch up with us,” Rasdall said.

There is also significant untapped growth potential as markets in Russia and India are currently closed to the US for geopolitical reasons, but they represent tremendous growth opportunities if circumstances change.

“There are many nuances in being an exporter compared to domestic sales such as country requirements that must be met – ever-changing tariff and free trade agreement landscapes as well as varying customer requirements and preferences,” Mills said. “Processors looking to export dairy products must have a good understanding of these areas or at least tap into resources that do.”

Photo: kokliang1981 - stock.adobe.com

Photo: kokliang1981 - stock.adobe.com

Flexibility in operations

Milk Specialties Global, Eden Prairie, Minn., is investing in the production of casein and caseinate as it recently began commercializing two different locations to help meet growing demand for these products. Additionally, the company customizes its high-protein functional ingredients for different global markets by being willing to adhere to various import regulations that might be different from US requirements. The company also caters to customer-specific requirements including differing criteria for ingredients ranging from moisture level to protein level, said Jing Hagert, vice president of human nutrition.

Offering such customization of products requires additional expertise from an operations standpoint and more manufacturing flexibility, Hagert said. Yet the company has been able to capture global interest as it has paid attention to the different applications of how proteins are being fortified into a variety of products around the world.

“We have to be open-minded and willing to understand the why and create a manner to handle those requests,” Hagert said.

This kind of flexibility includes developing lower-sodium cheeses for certain Asian markets, expanding testing to include the additional microbiological testing requirements in Europe and China, labeling in other languages, and offering different sizes of packaging, said Virginie Saulnier, vice-president of global dairy sales at Agri-Mark, Andover, Mass.

There has been interest in the Chinese market for fresh Wisconsin cheese curds, so some producers are working on recipes that can be frozen for shipping and thawed while still maintaining product quality, Nilsestuen said. She said modifications can also be made to accommodate color or salt preferences as well as browning, melting or stretching needs for different applications and markets.

“Customization like this requires investment, both in equipment and in research and development,” Nilsestuen said. “Partnerships with organizations like the Center for Dairy Research at the University of Wisconsin-Madison can help dairy manufacturers tailor their recipes, production and packaging for a variety of markets.”

Overall, international consumers purchased nearly 1 billion pounds of US cheese in 2022, Nilsestuen said.

Agri-Mark recently completed a $30 million expansion at its Chateaugay, NY, cheese production facility, which will allow the company to scale to meet domestic demand for cheeses and potentially support export opportunities.

“Processors that are looking to increase their export business need to first understand the targeted markets, their specific regulations regarding products’ specifications, import process – registration of plant, license, import permit, quota, etc. – the risks associated with dealing with overseas buyers and their different business ethics,” Saulnier said. “Be sure to consider the economic, financial (currency fluctuations) and sometimes political instability of these countries. Once that background work has been studied, then you must adapt and flex to meet these regulatory requirements while complying with US export regulations.”

Hilmar, based in Hilmar, Calif., has focused on boosting its business in international markets in recent years, including increasing cheese exports each of the last five years.

“Many of the same cheeses that are popular in the US are in demand around the world with the same consumer drivers such as convenience, taste and nutrition,” said Kyle Jensen, vice president of global sales and marketing. “Additionally, whey powders continue to serve the growing demand for protein around the world.”

To meet this demand, Hilmar is building a new production facility in Dodge City, Kan., and will begin shipping both cheese and protein ingredient products from the new plant in late 2024.

Next level of growth

To continue to expand the international market, Rasdall said it is important for exporters to know the intended destination market, its requirements and what’s required to effectively do business in a particular country. She also said being strategic, evaluating the market intelligence and having a presence in the country is also important. After all, US embassy staff across North Africa and the Middle East report the reason exports don’t perform as well in those countries is because representatives from US processors aren’t on the ground in those locations.

Given that focus on personal connections, getting back to seeing customers in person after pandemic limitations has been a tremendous help in more deeply understanding how to better serve customers, Jensen said.

Overall, the US is currently exporting 18% of its dairy production, and there is only room for growth with 95% of the world’s population living overseas and global trade growing at roughly twice the speed and volume as domestic consumption, Loux said. Additionally, focusing on exports helps processors diversify their businesses and remain strong when faced with headwinds.

“We have to make sure we are making the right products for the right customers,” Loux said. “That includes making sure you work with local partners on the exact specifications they want, and also that you find ways if you are going for a branded product to make sure it’s localized to the individual taste of the given market.”

Overall, the US is also changing its image when it comes to exports, Hagert said. While the country was previously considered to be the third largest dairy exporter behind New Zealand/Oceania and Europe, that perception has shifted, and the global industry is now looking to the US as a key producer and manufacturer known for delivering strong quality and innovation.

Source: US Dairy Export Council

| Graphic: Sosland Publishing Co.